Depreciation Book Value Formula

Calculating the Present Amount or Worth when the Book Value the Salvage Value the Total Estimated Life of the Asset and the Number of years of the Asset is Given. Considering the example of a computer that was purchased for 800 five years ago the formula can be written as.

Depreciation And Book Value Calculations Youtube

Depreciation per year Book value Depreciation rate.

. These templates for depreciation schedule are created by accounting experts and loaded with all essential formulas and formats to make calculation automatic and easier. Determining Book Value using MACRS Depreciation. Depreciation 2 Straight line depreciation percent book value at the beginning of the accounting period.

Ad Need an Easy Accurate Way to Comply with State Depreciation Across Multiple States. Declining Balance Method is sometimes called the Constant-Percentage Method or the Matheson formula. B 85.

Therefore the book value would be currently equal to. There are different depreciation methods. One can use these free templates for both personal and business.

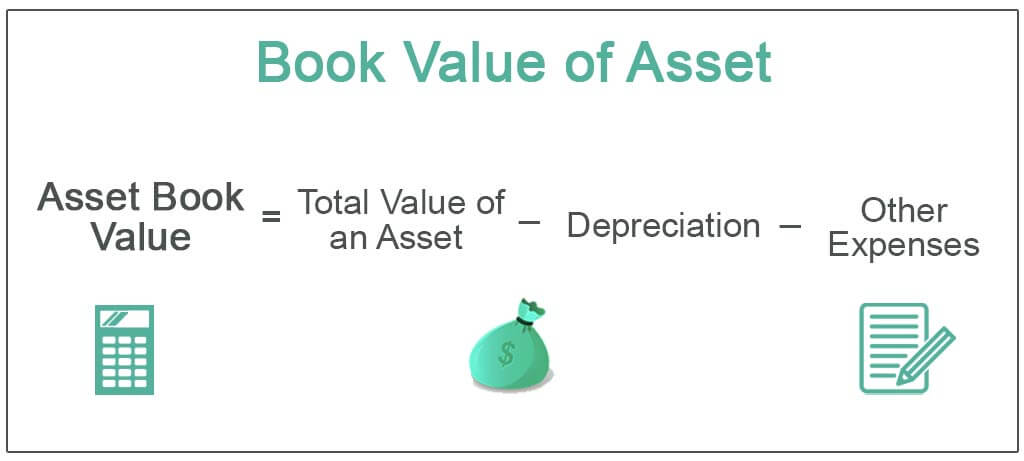

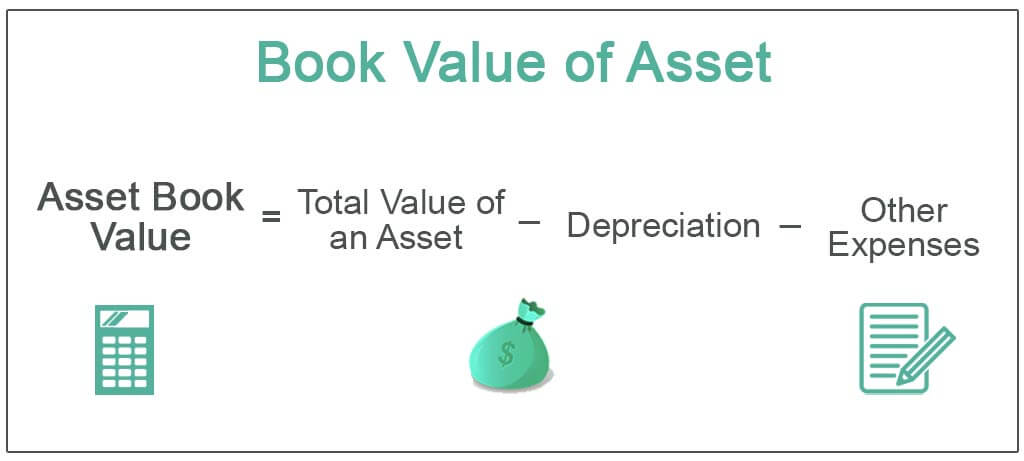

P B x N t S. You can use the following formula to calculate book value per share. Depreciation must be taken into account.

Net book value is among the most common financial metrics around. Depreciation by Declining Balance Method. Book value is also the net.

In order to get an accurate book value adjustments eg. The assumption in this depreciation method is that the annual cost of depreciation is the fixed percentage 1 - K of the Book Value BV at the beginning of the year. Depreciation Amount for year one 10000 1000 x 20.

To compute for book value three essential parameters are needed and these parameters are Present Amount or Worth P Rate of Depreciation α and Number of Years of the Asset t. Book Value 800 - 400. Use a depreciation factor of two when doing calculations for double declining balance.

Another way to think of book value is that it. Accumulated depreciation is the total depreciation of the fixed asset accumulated up to a specified time. Importance of Net Book Value.

Expertly Manage the Largest Expenditure on the Balance Sheet with Efficiency Confidence. Net Book Value 200000 60000 140000. In our example the NBV of the logging companys truck after four years would be 140000.

Depreciation Amount for year one Book Value Salvage Value x Depreciation Rate. Book value is the depreciable basis or historical cost minus accumulated depreciation. B P 1 α t.

P Present amount or worth. Double declining balance is the most widely used declining balance depreciation method which has a depreciation rate that is twice the value of straight line depreciation for the first year. Depreciation Amount for year one 1800.

It is important to use the average number of common shares as opposed to the total number of common shares at the end of a. The depreciable basis is the amount paid for the asset including all costs related to acquisition such as installation transportation and modification costs. Book value Cost of the asset accumulated depreciation.

P Present worth or amount. B Book value of an asset. The formula for calculating book value.

The closing value for year one is calculated by subtracting the depreciation from the opening value of the asset. Depreciation Schedule FormulaOnce purchased PPE is a non-current ie. Therefore the book value is 85.

B Book value over a period of time. 10000 2700 7300. Book value of an asset is the value at which the asset is carried on a balance sheet and calculated by taking the cost of an asset minus the accumulated depreciation.

On April 1 2012 company X purchased a. Accumulated Depreciation 15000 x 4 years 60000.

.jpg)

Net Book Value Nbv Definition Meaning Investinganswers

Book Value Of Assets Definition Formula Calculation With Examples

How To Calculate Book Value 13 Steps With Pictures Wikihow

How To Calculate Book Value 13 Steps With Pictures Wikihow

Net Book Value Meaning Formula Calculate Net Book Value

How To Calculate Book Value 13 Steps With Pictures Wikihow

0 Response to "Depreciation Book Value Formula"

Post a Comment